No matter what the industry, being able to properly do bookkeeping for small businesses is extremely important. It might look like a daunting task at first, but it is definitely doable and can be very rewarding if you manage to do it right.

As any business owner can attest, simply maintaining an existing venture involves dealing with a lot of paperwork by default. Bookkeeping is just one of many tasks that are absolutely essential to ensure that you don't lose track of anything - especially concerning the financials.

With that said, bookkeeping as a process has definitely evolved and there is currently more than one way to do it right. In particular, it is now considerably easier than it has ever been before. This is thanks to the availability of user-friendly bookkeeping software that can be used to not only create but also track financial records for any business.

What is bookkeeping?

Bookkeeping is the process of taking all the pertinent financial transactions involved in running a business, then recording them and classifying them in an easy-to-track and easy-to-understand manner. Typically, the main reason for doing so is to stay on top of all the incoming and outgoing transactions for the business.

In the past, bookkeeping used to be done through physical books, journals and ledgers - which is where the term bookkeeping comes from. However, the easiest way to do bookkeeping for small business nowadays is through the use of bookkeeping software.

Other small business bookkeeping duties include updating a balance sheet, creating an income statement, handling payroll, and generating analysis and reports that can be used for specific tasks - all of which are need to be done for the continuation of the business.

How software can help

These days, the most efficient way of doing bookkeeping for small businesses is by using software. There are a number of great options for software-based bookkeeping regardless of what kind of computer you're on. The main reason for relying on software solutions instead of traditional means of bookkeeping is to take advantage of the many benefits that this entails.

For instance, software can be used to significantly speed up the entire process, make sure that all the data at hand is accurate, and reduce the possible points of error. Some examples of how a software-based bookkeeping solution for your small business can vastly improve your process can include:

-

Improve and speed up reconciliation

-

Automatically deduct and pay bills at set intervals

-

Send automated invoices to specified recipients

-

Send notifications when sales invoices are paid in real-time

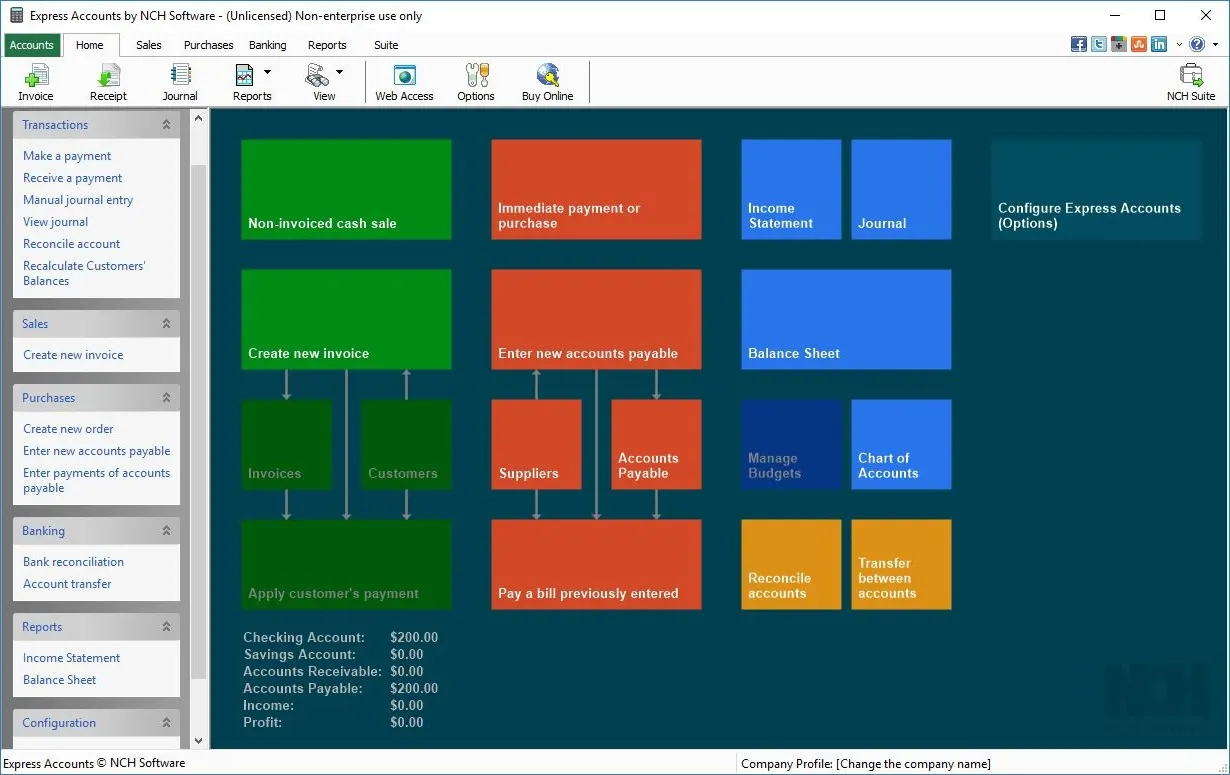

One of the best accounts and bookkeeping programs available for Mac and PC is Express Accounts Accounting Software. It’s the all-in-one bookkeeping software solution from NCH Software that anyone can easily download and set up to run within a matter of minutes. It’s a popular choice for those who are looking for a powerful yet accessible tool for small business bookkeeping.

Express Accounts Business Accounting Software

With Express Accounts, you can reliably focus on all the most important bookkeeping tasks such as invoicing, managing payments, reviewing entries, and even generating all the relevant reports that you need. It's definitely well-suited for small businesses that need to keep track of all their incoming and outgoing cash flow - through all sales, receipts, purchases, and payments.

Software-based solutions have gained a lot of traction compared with traditional methods because of the high level of convenience that they offer. They can make the whole process much quicker and more accurate while reducing the number of pain points that involve humans working on things manually. As they free up your time, you’ll be able to set your sights on other parts of the business that need your attention.

Conclusion

Doing bookkeeping for small business doesn't have to be as complicated and cumbersome as it used to be. This is especially true nowadays as the brunt of the work can be easily handled with the use of software tools like Express Accounts, which provide powerful features in a single unified package. Since getting a company's set of books right is of utmost importance, you've got to make sure that you do it right. You can do that by investing time, money, and other resources into solutions that are proven to work.

Frequently Asked Questions

Why do small businesses need bookkeeping?

Small businesses need bookkeeping because being on top of one's accounting is perhaps the most important requirement to running a successful and profitable business. Good accounting will let you monitor cash flow, keep expenses in check, and even spot errors that might negatively affect a company's finances in the future. It can also automate a number of smaller tasks that are part of the whole process, helping you save time and resources.

Desktop-based or online bookkeeping software?

When it comes to bookkeeping software options, you can go with either a desktop-based or cloud-based online solution. One of the biggest differences between these two is their respective costs or preferred method of purchase.

Online-only cloud-based options usually come with a monthly subscription. That means you have to pay a certain amount each month in order to access all the features. Meanwhile, a desktop-based option like Express Accounts is available with a one-time purchase option, which grants you a single license to use it to the fullest as much as you want.

What are some basic tips to getting bookkeeping right?

-

Keep a record of all transactions - The only way to truly stay on top of your company's books is by recording every single one of its financial transactions. In simple terms, be sure to note literally all business-related transactions. This will serve as tbe foundation for the well-kept set of books that any small business should aspire to have.

-

Perform reconciliation - To do reconciliation, you have to cross-reference your records against bank statements and make sure that all balances and transactions match up. This can be done daily, weekly, or monthly. The point of doing so is to ensure that there are no errors that need to be corrected and prevent them from piling up.

![Wilcom Embroidery Studio E4.5 Free Download [32-64 Bit]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjPfs6gd6JjSIjyKbh0R6bps9qr-CPZxfLbLm2ZEseSFnZACf0dFNcSLurkyJvgPzPYOafZTd7-SAYTu_p8N3PxsP_0gqy84ep_GzG0W5BKBCZpovvgCO5BB1z81B6deJsGy7A7FocUXrxuIfDXshFZQi8QkfxAhzlMu_OPdl9TrVPME3fLERO5CuZN9wuP/w74-h74-p-k-no-nu/Wilcom%20Embroidery%20Studio%20E4.5%20Free%20Download.png)